Driving around Molly Curry’s condominium complex in Ft. Lauderdale, it’s obvious she is proud of her neighborhood. She lives in the Bay Colony Club Condominiums, in a condo she owns since 2000, when she moved in with her two school-aged daughters. They are adults now and no longer live with Molly, but she’s stuck around and hopes to start a new career from her home.

Molly used to work for a company providing software to auto dealerships. Now, at 60 years old, she’s starting a new career -- as an entrepreneur. She is starting her own business connecting companies doing business with car dealers, like websites, marketing services, and media.

She’s bootstrapping her start-up herself from her condo, the same one her mortgage company says no longer needs flood insurance. That sparked her question to our Palm Readers project.

SEE RISK TO TAXPAYERS BELOW

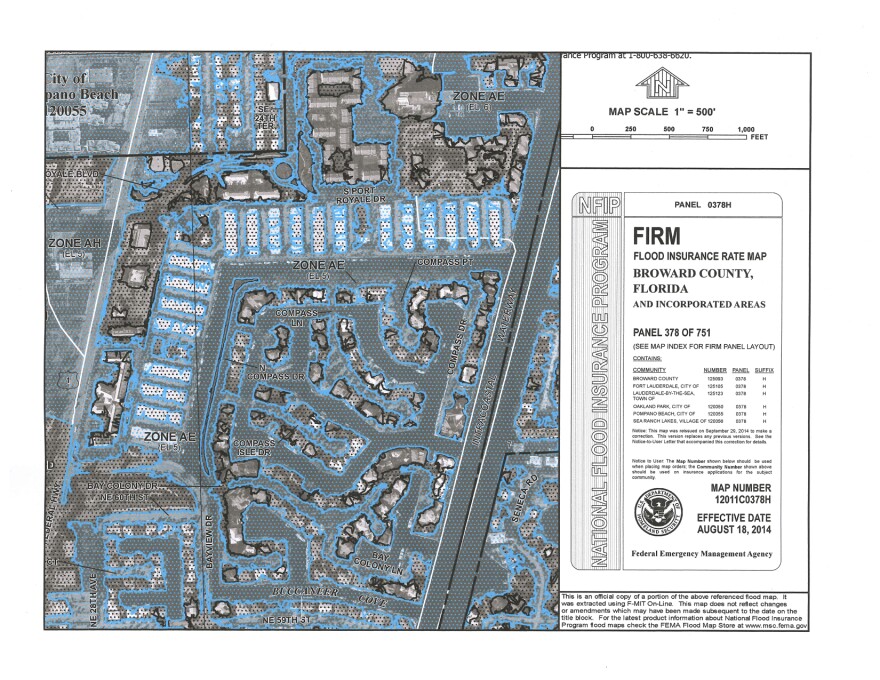

In March, Molly received a letter from her mortgage company saying she no longer needed flood insurance. For years, the complex was in a special flood hazard area. That means any property in the area with a mortgage needs to have flood insurance. Here's the flood zone map of Molly's complex from 2000:

For hundreds of thousands of people in South Florida, flood insurance is a fact of life, whether they’ve ever been flooded or not. If you live in a certain type of flood zone and you have a mortgage, you probably are required to buy flood insurance. Consider this the property mortgage mandate when it comes to flood insurance.

The average premium in Florida is a little more than $500 a year. For that homeowners get $250,000 of coverage for their homes. Non-residential buildings can buy up to $500,000 of coverage.

That coverage is provided by the National Flood Insurance Program and backed by American taxpayers.

CHECK YOUR FEMA FLOOD ZONE

Curry's condominium association is just one of more than 700,000 properties with flood insurance in South Florida. The mortgage on her condo required that she carry flood insurance because of the neighborhood was designated flood zone AE. It was last updated in 2014, when FEMA revised flood maps for Broward County. Here's what that 2014 map looked like for Curry's complex:

The 2014 maps continued to rate Curry's complex as flood zone AE, a designation that requires flood insurance if the property has a mortgage. "A" flood zones have what FEMA considers to be a high potential of flooding. That means there's a one percent chance of flooding each year. The classification falls under the general description of a special flood hazard area.

Broward County flood maps were updated three years ago. Miami-Dade's maps were revised in 2009. Palm Beach County is bracing for it's first update in more than 30 years.

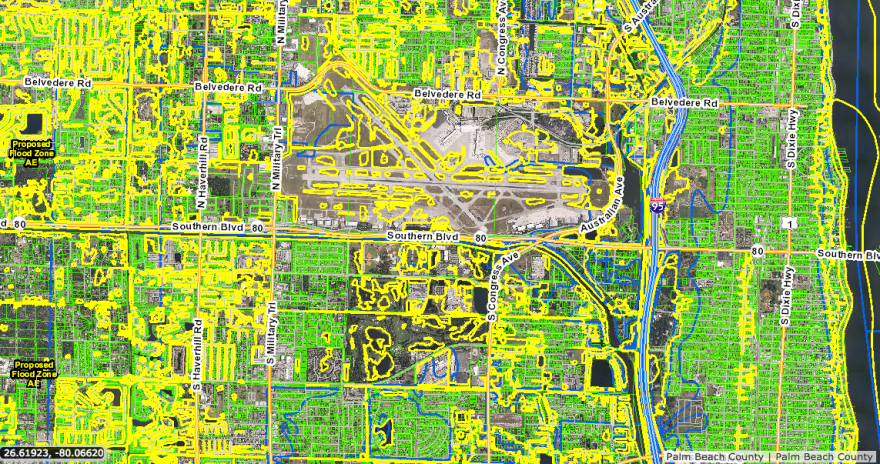

Here are some of the preliminary new flood zones in yellow. You can check your address at this link. (Click on layers, select "Commonly Used Layers," check "Flood Zone Map" and "Proposed Flood Zones.")

As the image shows, there are areas in western Palm Beach County that are due to be reclassified as flood zones. That could force property owners, if they have a mortgage, to buy flood insurance.

But it’s the opposite for Molly Curry, the Ft. Lauderdale condo owner who learned from her mortgage company that she no longer needed flood insurance. But it wasn’t the federal government who determined her property no longer was at a heightened risk. It was a her condominium association board and Brent Spencer of Florida Floodzone Services, the guy hired to appeal it’s flood zone rating.

Spencer’s work showed the buildings themselves were above the base flood elevation for the complex. That allowed the Federal Emergency Management Agency to issue a Letter of Map Amendment or LOMA. It is the official re-designation of a property’s flood zone. The revised 2017 map of the complex helped lead to the change in flood zone.

Why the revision? Better technology through the years allows for more accurate measurement and assessment, according to Spencer.

To Molly’s question about the criteria for a flood zone -- the criteria hasn’t changed necessarily, it’s the technology measuring landscapes figuring out the risk to flood waters.

RISK TO TAXPAYERS

Behind Molly’s question is a government backed insurance program that dates back to 1968. Private insurance companies couldn’t make any money offering flood insurance so the federal government stepped in with the goal of providing coverage while working with communities to reduce the risk of catastrophic flooding.

Congress first started taking taxpayer-backed flood insurance seriously after the 1965 hurricane season and the devastation caused by Hurricane Betsy. That storm was a major hurricane as it moved through the Upper Keys then through the Gulf of Mexico and turning north into Louisiana, coming ashore near New Orleans. Betsy was the first $1 billion hurricane. She also led the U-S Army Corps of Engineers to build a flood protection levee system for New Orleans.

Does this sound familiar?

Forty years after Hurricane Betsy, another storm -- Hurricane Katrina -- would take a similar path through South Florida on her way to devastating New Orleans. That storm sent the National Flood Insurance Program billions of dollars into debt.

Today that debt that totals $25 billion thanks primarily to Katrina and Superstorm Sandy in 2012, according to Roy Wright, director of the program. "That debt is entirely attributed to the direction Congress has given us as to how to pay claims."

The program last borrowed more than $1 billion in January to pay claims filed after Hurricane Matthew and inland flooding that swept through parts of Maryland, West Virginia and Louisiana.

Because the flood insurance program allows property owners to grandfather their flood insurance rates, Wright figures about 20 percent of insured properties are paying premiums that do not accurately reflect the risk to flooding. "That is what opens up and causes the financial vulnerability," said Wright,

Florida is home to more flood insurance policies than any other state by a factor of three. Almost 1.8 million properties carry flood insurance in the state. One out of every eight flood insurance policies in the nation cover a property in South Florida. And even though Florida is most prone to hurricanes, it isn’t the state that has pushed the National Flood Insurance Program into the red and kept it there for more than a decade.

Just $2 million in flood insurance claims were paid across the four South Florida counties in 2016.

"I want folks to know for certain that if they have a policy with the National Flood Insurance Program and they experience a flood loss, we will pay," said Wright.

REAUTHORIZATION

The program is due to expire on Sept. 30 unless Congress renews it. Without it, "the economy in the United States pretty much shuts down," warns Don Dresback, Executive Vice President of the Beacon Group, a Boca Raton-based insurance brokerage. "Anyone who is located in a special hazard area wouldn't be able to qualify for federally guaranteed loans." He warnings: "It would pretty much shut down business and real estate."

It is a fate the flood insurance director is determined to avoid. "I hear a clear commitment to a multiyear on-time reauthorization of this program," said Wright. Legislation has been filed to continue the program for another decade. Reform efforts include encouraging private insurance companies to offer more flood insurance.

The private flood insurance market is very small. According to the Florida Office of Insurance Regulation fewer than 10,000 flood insurance policies were written by private insurers last year. While that’s a 10-times increase from a year earlier, it is a fraction of the almost two million properties using the taxpayer-backed system. Reform supporters say legislation should clarify that private flood insurance is acceptable by mortgage lenders requiring the coverage. "We must put ourselves in a position there is private capital and private acceptance of the risk in order" to expand flood coverage according to the NFIP's Wright.