Raphael Bostic is one of the more patient voices of the Federal Reserve System. Yet, during a visit to Broward County last week, he also was steadfast in his commitment to bring inflation down — even if that means higher interest rates.

Bostic is the president of the Federal Reserve Bank of Atlanta. The bank's region includes Florida. He has been one of the more dovish Federal Reserve officials regarding the need now for higher interest rates even as he clearly has the appetite if inflation remains above the bank's long-term goal.

Bostic has said he thinks the central bank's interest rate is high enough to help bring down inflation. He has advocated for patience for the economy to realize the full effect after 18 months of interest rate hikes. He repeated that message Thursday to an audience at Broward County.

"I feel like we're in a restrictive space now, and now we just need to let that restriction play out," Bostic said.

During a second stop during his visit, he spoke more firmly that he was not declaring victory over high inflation as the national rate has fallen to 4%. In South Florida, it remains even higher.

"We can't just let it just sit there," he told an audience of Broward business leaders. "If you have no other takeaway from today, inflation is too high and we're going to get inflation back down to our 2% target. I'm going to do whatever it takes to do that."

The 2% inflation level is a hugely important number because it is the Federal Reserve’s official inflation target. And while Bostic has said patience is needed after a year-and-a-half of sharply higher interest rates, he also spoke more firmly about his conviction — and the Fed’s — to squeeze inflation more if it doesn’t continue dropping.

"We have to get that under control and we're going to do it. I think we're in a place where we're on the pathway to do it, but it's way too early to declare victory," he said Thursday night.

These were his last comments before the next interest rate meeting by the Fed, which happens later this month. Central bankers limit public comments for about two weeks before an interest rate decision. Bostic takes part in the debate, but he does not have a vote on the panel this year.

Patience, too

Bostic has advocated for patience since July, when he told WLRN he was comfortable "giving more time to see how our policy plays out."

His colleagues on the Federal Reserve Open Market Committee were not. Later that month, the group voted to increase its target short-term borrowing rate again, after a robust jobs report for June included stronger than anticipated wage increases. Such pay increases can help reinforce inflationary trends, which the Fed is adamant about cooling after making the mistake of calling inflation "transitory" in 2021.

"We've got to get [inflation] back under control."Federal Reserve of Atlanta President Raphael Bostic

The Federal Reserve has two mandates — full employment and stable prices. As Americans, and especially South Floridians, have experienced in the past two years — high inflation means unstable prices.

Despite Bostic's patience, he delivered a clear and unwavering defense of the Fed's inflation fight while in Fort Lauderdale.

"If it seems like the trajectory [of inflation] is going to a harder place, we're going to have to act. [It] is not discretionary because we've got to get this back under control," he said.

While the inflation rate has been more than cut in half since the summer of 2022 when it hit 9 % nationwide, South Florida inflation has remained stronger for longer than almost anywhere else in the country. In June, prices in the Miami-Fort Lauderdale-Palm Beach area had risen 6.9% compared to a year earlier. Only Tampa area prices outpaced those in South Florida.

The stubbornness is due to the same factor in both locations: housing. The inflation rate fell to under 1% for all items except housing.

South Florida is one of the least affordable housing markets in the nation thanks to a combination of high home prices and rents and incomes lower than average. And the Fed's actions to fight inflation have made homes and condos more expensive for buyers who have to borrow money.

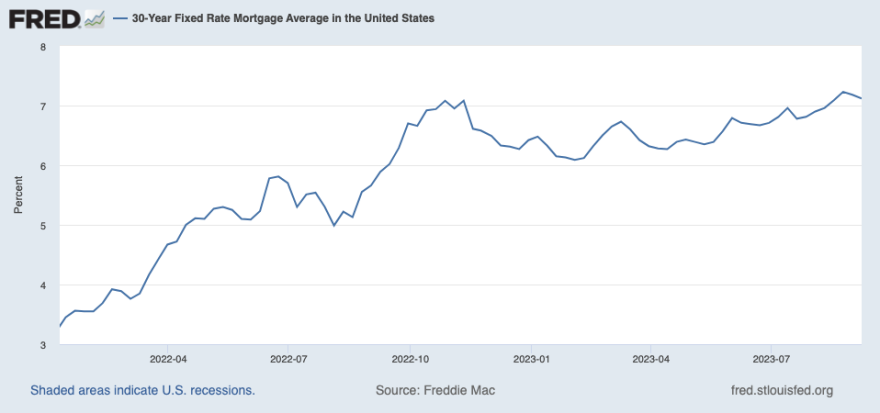

The average 30-year fixed rate mortgage has more than doubled since the beginning of 2022. The move has increase a monthly mortgage payment for a $500,000 mortgage by 50%.

The inflation statistics through August will be released later this week.