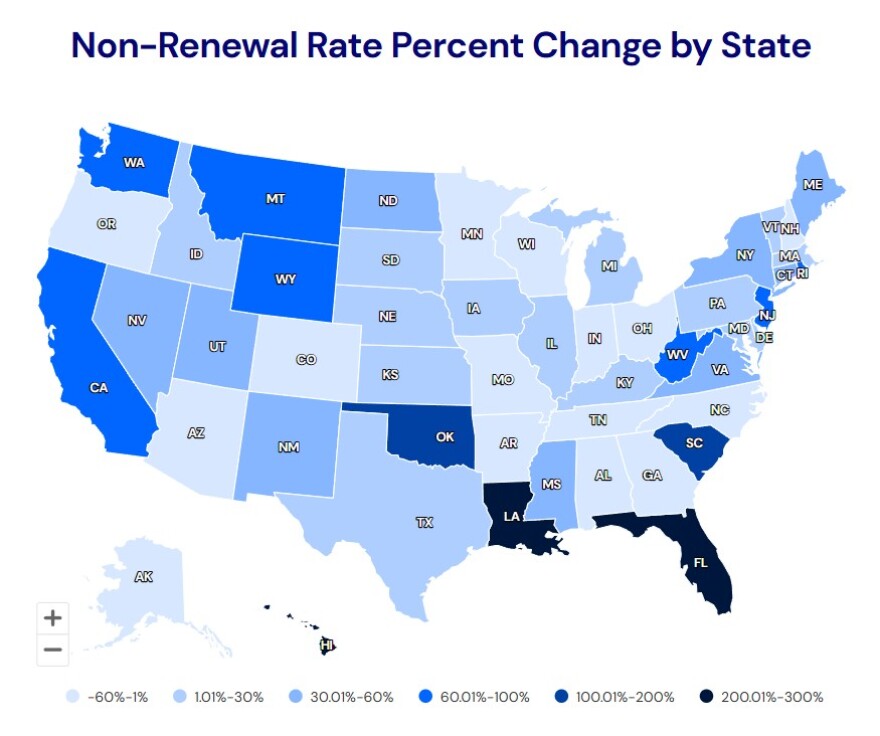

New data analysis found Florida leads in home insurance non-renewals.

The information comes from Insurify, an insurance comparison website, reporting that homeowners policy non-renewals rates in the state almost tripled in five years — with numbers spiking 280% from 2018 to 2023, the steepest rise in the nation.

At time of renewal, which comes usually once a year, insurance policy holders make their customers new offers — these can include different terms, such as changes in coverage, as well as higher or lower premiums. Customers then choose to either accept the offer and renew or go with another insurance company, while about 20% of Florida homeowners choose to go completely uninsured. However, this new analysis reveals an alarming trend, according to Insurify Data Journalist Julia Taliensin, one of the reports' authors.

READ MORE: Congresswoman Frederica Wilson pitches legislation to alleviate national property insurance crisis

Taliesin said that a U.S. Senate Budget Committee report shows most of these non-renewals are being initiated by the insurers – not the consumers. She said insurers are trying to balance or reduce their risk exposure due to Florida's increasing and intensifying extreme weather events, and these surging non-renewals are leaving homeowners scrambling to find coverage.

"I don't want to sugarcoat it: It's really hard – especially in high-risk areas of Florida, sometimes finding new coverage affordably can be a challenge. So, I'm not telling anyone to move," she said, "but it may be that this climate risk is starting to kind of price people out of certain regions."

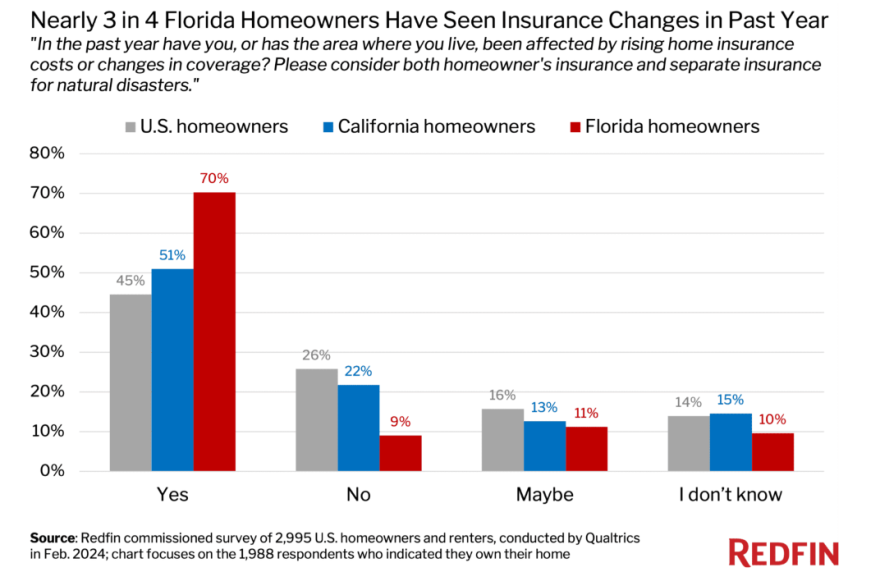

Though recent reforms aim to bring stability to Florida's home insurance market, homeowners have still faced high costs. Insurify's latest report breaks down why climate risk is making insurance harder to get and far more expensive for Floridians, including record-breaking storm-damage claims and payout dollar amounts.

Other key findings included:

- The projected annual cost of homeowners insurance will hit $15,460 in 2025, nearly five times the national average.

- Despite the high cost, Florida home insurance premiums decreased by about an average of 3% last year.

- In 2024, weather catastrophes were responsible for 97% of insured losses worldwide.

Taliesin said Florida homeowners have options, such as Citizens Property Insurance Company, the state-backed insurer of last resort, and the My Safe Florida Home program, among others. Citizens was overwhelmed with policies but has been able to depopulate recently, and the MSFH program is open and receiving applications now, but qualification requirements are not for everybody, and some people may be out of luck.

"If someone's really on their last leg, it is very possible that they would be able to find coverage through a state run program, like Citizens. That's kind of what it's made for, right? But that doesn't mean it's cheap," she said. "Florida does have programs available to homeowners to help fortify their homes, and many insurers offer discounts on installing storm mitigation measures."

Other options for homeowners who are not being offered policy renewals, Taliesin said, include shopping around with local insurers, smaller companies, and considering banks for loans and credit lines that could help pay for expensive repairs or the necessary maintenance that keeps a home insurable. To her, homeowners should "shake every tree" to find help.

At Addition Financial Credit Union in Orlando, Addy Perales, Consumer Lending Manager, said they see people wanting to secure a home equity loan of some sort to replace their roof or pay for other expensive repairs in order to get or remain insured.

"Personal loans are probably the quickest way for them to get funds to be able to help them pay for any repairs that they may have to do," Perales said. "We also offer Home Equity Lines of Credit – those take a little longer – but they can use the equity in their home to finance that extra amount needed to do the repairs."

HELOCs come with lower interest rates due to the home going up for collateral, but if a person has already lost insurance, they're not eligible. That's when a personal loan can be the answer. Perales said that although going into debt is always a tough choice, it can mean the difference between someone keeping or losing their home.

"It can cause somewhat of a paradox indefinitely," Perales said. "And if they were to put a claim in, (their insurer) might not cover the whole amount, so (the consumer) might have a residual that they still have to take care of so that they continue to be insured, and that's where a loan or credit line can step in, too."

Once HELOCs are paid off, Perales said, customers can keep the line open and have it, as peace of mind, to use in case of emergencies. And if a customer is not able to take out a loan or credit line, financial advisors will still educate homeowners and help them find alternatives, even other institutions or programs, that might help them or best fit their situation, so she suggests that people take the time for a consultation at the banking institution of their choice.

Lillian Hernández Caraballo is a Report for America corps member.

Copyright 2025 Central Florida Public Media