Students and professors are responding to new federal student loan limits passed by Congress this year as part of the Trump administration's One Big Beautiful Bill.

The Department of Education drafted regulations based on those limits that tie new borrowing caps to whether a program is defined as "professional."

Included in this bucket, as defined in the Higher Education Act of 1965, are around a dozen programs, including medicine, pharmacy, dentistry and law. Graduate students in these programs can borrow the most: up to $200,000 in federal student loans.

READ MORE: Gov. Ron DeSantis proposes $117 billion budget. Would boost salaries for teachers, law enforcement

Meanwhile, graduate students in programs not classified as "professional" — such as nursing, therapy and social work — will be limited to a loan of $100,000.

The new limits will take effect in July once they are finalized by the Education Department. Graduate students already enrolled in programs will be grandfathered in at the current limits.

Backlash over 'professional' reclassification

The reclassification of "professional" degrees went viral on social media, with many critics saying female-dominated industries were the target of borrowing caps.

Others warned that the move could force more students to take out higher-interest private loans, disproportionately impacting lower-income and first-generation students.

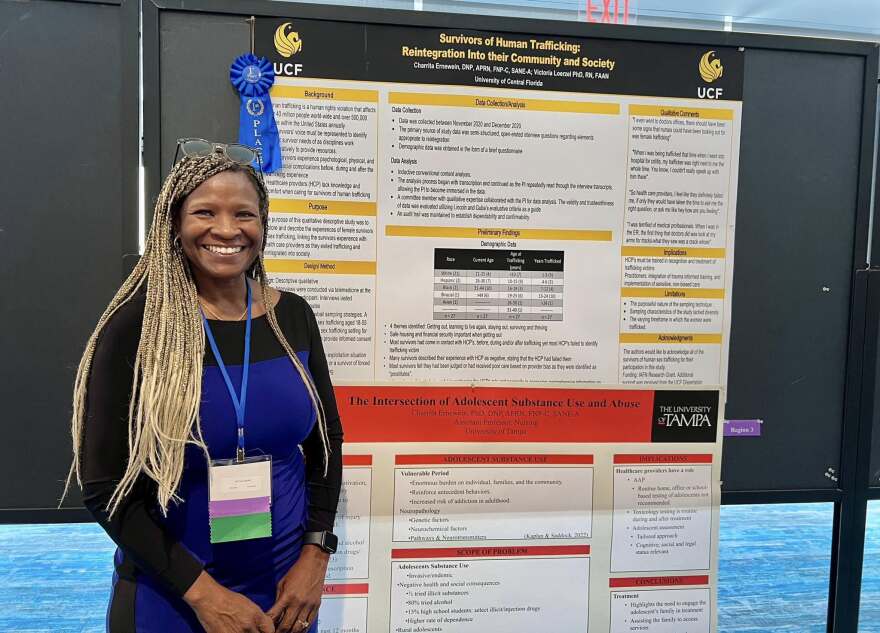

Charrita Ernewein is a nurse practitioner and assistant professor at the University of Tampa.

She's also the president of Tampa's chapter of Sigma Theta Tau, the International Honor Society of Nursing, which recently published a statement decrying the Education Department's omission of nurses from a list of professional degrees.

"Nurses are often unseen, undervalued and left out of decisions that profoundly shape our profession," the statement said.

Ernewein agrees.

She said the new caps could make it harder for students who want to follow in her footsteps as a nurse educator and make the nursing shortage worse.

"We're not going to have professors to teach them because they are part of that … master's degree group that is identified as a nonprofessional," she said.

Ernewein said that her education — which included a bachelor's, master's and doctoral degree to nurse and teach — cost well over $100,000 in tuition alone, not including the cost of living.

Although the reclassification only impacts borrowing caps and does not impact nurses' accreditation or licensing, Ernewein said being perceived as a "professional" also matters at a time when her field is fighting for more practice privileges and better wages.

She pointed to a recent experience with a colleague in a clinical setting that crystalized the issue for her.

"I was working with a physician who was doing something with another patient. … He point-blank said, 'Well, I'm a professional. Nurses are not professional.' This is what I'm concerned about," Ernewein said.

The Education Department recently published a memo in response to the "certain progressive voices [that] have been fear mongering" over degree reclassifications.

"The definition of a 'professional degree' is an internal definition used by the Department to distinguish among programs that qualify for higher loan limits, not a value judgement about the importance of programs. It has no bearing on whether a program is professional in nature or not," the memo said.

The statement by the department also said "commonsense limits" on borrowing should drive down the cost of graduate programs and reduce student debt.

Preston Cooper, a senior fellow specializing in student loan reform for the conservative think tank American Enterprise Institute, agrees.

He said the recent "sky is falling" narratives around the new loan limits are not in line with the reality of the situation.

"These new loan limits are really meant to curtail debt for the highest cost, most expensive programs out there that, quite frankly, should be charging less than they are right now and have only been able to charge that much because Congress had made unlimited student loans available," Cooper said.

New caps could cool tuition costs

In 2006, Congress enacted the Grad PLUS program, which effectively allowed students to borrow unlimited amounts from the federal government.

Since then, graduate school debt has increased significantly, according to an analysis by the public policy think tank American Enterprise Institute.

Cooper, who authored the report, said the new caps are supposed to rein in colleges charging high tuition for programs with low-earning potential.

"So, I believe that this is going to be a positive change, which is going to reduce student debt and encourage more cost discipline among colleges," Cooper said.

Most graduate students borrow within the new limits, and those borrowing above the new caps are mostly attending overpriced private institutions, he said.

"So, there will be some choices that both institutions and students have to make here," Cooper said.

There's been two early examples of ways institutions could respond, Cooper said.

Some programs, like Harvard Law School, started administering their own student loans. Another law school, at Santa Clara University, provided a $16,000 tuition scholarship to all incoming students, citing the new federal loan limits.

At the University of South Florida, pre-vet student Olivia Vignali said the expiration of Grad PLUS loans is a major factor in her financial planning for graduate school.

Veterinary medicine, which is considered a "professional degree" under the new loan limits, would allow Vignali to borrow $50,000 a year, up to $200,000.

She plans to apply to in-state and out-of-state programs, which range in tuition from $30,000 to $70,000 a semester, she said.

The new limits are forcing her to prioritize lower-cost programs and programs that offer scholarships," she said.

"The new cap makes me think realistically," she said. "I'd rather keep debt manageable than rely on expensive private loans later."

Gabriella Paul covers the stories of people living paycheck to paycheck in the greater Tampa Bay region for WUSF. Here's how you can share your story with her.

Copyright 2025 WUSF 89.7